Wall Street predicts that the culmination of Basel 3 will significantly disrupt climate finance.

The planned implementation of Basel 3, referred to as the “Basel 3 Endgame,” signifies the final stage in the US adoption of regulations developed in response to the 2008 financial crisis. Under these regulations, banks will be required to allocate more capital, leading to increased costs in providing financial services.

Wall Street Says Basel 3 ‘Endgame’ Will Upend Climate Finance

Proposed by a group of US authorities, including the Federal Reserve, the rules are expected to fundamentally reshape how banks in the world’s largest economy approach risk, according to EY.

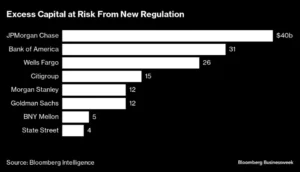

JPMorgan Chase & Co. estimates that the proposed plan would necessitate a 25% increase in capital, impacting its ability to allocate funds to green projects. Goldman Sachs Group Inc.’s CEO, David Solomon, recently noted that the firm’s capital requirements would quadruple for certain clean energy projects.

This anticipated shift in regulatory landscape is prompting Wall Street to reassess existing structures in climate financing. John Greenwood, co-head of Americas structured finance at Goldman, emphasized that commercial banks are facing challenges under Basel, making the financial structures of existing climate deals appear outdated. Particularly, climate funding models like blended finance, where public sector incentives de-risk deals to attract private capital, will need to consider banks’ additional capital costs.

Ross Stores surpasses Expectations with Robust earnings in the Third quarter of 2024.

The eight largest US banks currently have capital requirements ranging from $9 to $13 for every $100 in risk-weighted assets. Under the new rules, they would need to add approximately $2 more. Greenwood suggests that, with the incremental capital required for the green transition, banks will seek collaboration with other areas of private finance not subject to the same regulations. This highlights the need to support institutional investors given the constraints that commercial banks face under Basel.

This development is a reality check for the finance industry, which emphasized during the COP28 climate summit that it would participate in the green transition only if returns are appealing.

Bankers stress the importance of making a profit, and private capital’s involvement depends on achieving a commercial return, according to figures like hedge fund billionaire Ray Dalio and Shriti Vadera, chair of Prudential Plc.

According to Jeff Berman, a partner at Clifford Chance, Wall Street is now grappling with a trade-off between the safety of the banking system and the goals of climate policy. Bankers convey that achieving a commercial return will become more challenging with increased capital requirements, leading finance to shift from banks to the less-regulated realm of shadow banking.

2023 Best Credit Card to use in USA

Goldman’s Solomon warns that financing in less visible market corners could accumulate risks, potentially leading to financial shocks. JPMorgan CEO Jamie Dimon echoes concerns about a shift toward less-regulated markets, emphasizing the potential impact on regulated entities’ safety and soundness.

Multilateral development banks acknowledge that adjustments may be needed in green finance models due to the regulatory environment. The president of the European Bank for Reconstruction and Development, Odile Renaud-Basso, notes that Basel 3 could provide a reason for global banks to step back from climate finance, urging a closer examination of elements affecting emerging market risk.

As Wall Street warns about the impact of stricter capital rules on various financial sectors, including mortgages and small business loans, the focus is on the trade-off between the banking system’s safety and climate policy goals. Citigroup suggests that regulators consider the unintended consequences of structures like Basel 3, which may hinder investment in infrastructure projects crucial for climate and development finance.

The U.S. hasn’t avoided a recession (yet). However, these indicators suggest a safer landing.

The Basel 3 rules pose challenges for financing green infrastructure for banks, according to Citigroup’s Jay Collins. These challenges arise because green infrastructure is typically funded at the project level, often long-term and illiquid, aligning with lending discouraged by Basel rules. Collins emphasizes that as long as there is policy noise and regulatory uncertainty, a significant increase in climate investment may not materialize.

Hendrik du Toit, CEO of Ninety One, expresses concerns that American and European financiers, already risk-averse, may further hinder emerging markets in need of climate finance. He advocates for changing the conservative approach to Western capital, emphasizing the potential returns in emerging markets.

The risks associated with climate finance are highlighted by this year’s challenges, including higher interest rates and supply-chain bottlenecks impacting key green sectors. The S&P Global Clean Energy Index’s 30% decline in 2023, compared to a 23% gain for the S&P 500, underscores the financial challenges in the green sector.

Citigroup’s Collins concludes that global banks will continue to struggle to meet regulatory capital return hurdles on green infrastructure under the Basel rules. The ongoing struggle emphasizes the complex interplay between regulatory frameworks, financial returns, and the imperative of addressing climate change.

For more news click

-

2023 Best Credit Card to use in USA

-

A criticizer excludes on a $6 million grands by selling his own Apple stocks for about 70000% of its current Value on date.

-

Forbes Hall of Shame List, Crazy Here is the list.

-

Ross Stores surpasses Expectations with Robust earnings in the Third quarter of 2024.

-

The U.S. hasn’t avoided a recession (yet). However, these indicators suggest a safer landing.